Adam English

|

Wednesday, July 24th

Every time someone in America buys electronics or a car — or even cracks open a can of beer — Goldman Sachs gets paid.

A breaking story from the

New York Times has all the details...

Three

years ago, this too-big-to-fail bank capitalized on special rules

created by the Federal Reserve and authorized by Congress by buying an

obscure company called Metro International Trade Services. It is one of

the largest warehousing companies for aluminum in the country.

Since then, it has manipulated the system to pull in massive profits.

In

spite of tepid demand for aluminum worldwide after the Great Recession,

the amount of time required for aluminum delivery has increased 20-fold

— from six weeks to 16 months — since the company was purchased. This

could be explained by shortages or logistical issues, if any existed.

The company is actively making the process inefficient.

Since

2008, the stockpile of aluminum grew from 50,000 tons in 2008 to a

massive 1.5 million tons today. Industry rules require at least 3,000

tons be moved out of warehouses each day.

However, instead of

delivering the metal to buyers, Goldman is just shuffling the metal

between warehouses to skirt the intent of the rules.

The

warehouses collect rent for each day the metal is stored. Storage costs

are a primary factor for the premium added to the price difference

between the spot market and the actual price charged for delivery.

Estimates show this premium has

doubled

since Goldman's acquisition. For every ton delivered, an extra $114 is

charged. With how much aluminum is used in everything from soda cans to

automobiles, estimates put the extra cost to American consumers at $5

billion over three years.

This business has been so lucrative that

Goldman plans to expand the operations. It recently filed documents

with the SEC outlining its plan to store copper in the same warehouses.

No Exception to the Rule

The list of manipulations by mega banks touches every corner of finance.

Virtually every commodity has been hit by massive positions that influence prices for illicit gains...

LIBOR

and delaying interest rate information amounted to $880 trillion in

manipulation alone, and affected every mortgage and loan worldwide. And

JPMorgan is all over the news, turning money-losing power plants into

profit centers by manipulating the market and being paid for not firing

up the plants.

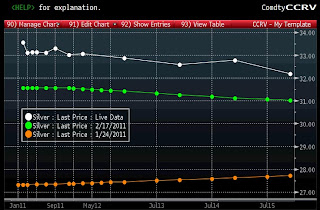

But bring up any of these topics, and you'll hear

the same cynical responses. Mention silver manipulation, and it will be

dismissed as fringe conspiracy theory.

In an age where everything

is being manipulated, it defies belief that somehow silver prices aren't

being abused for illicit gains. It requires willful ignorance. The fact

is, there is plenty of evidence staring everyone right in the face.

Let's just have a look at JPMorgan...

JPMorgan's Silver Cash Grab

JPMorgan

inherited a massive amount of silver shorts priced between $20 and $21

when it took over Bear Stearns. Combined with HSBC, the two mega banks

covered 85% of all silver shorts.

That right there is a solid case

for manipulation — because the short position was so massive compared

to physical silver trading and long positions. What's worse, the U.S.

Treasury created the situation.

If the free market resolved the situation, silver would have more than doubled as the short position was covered and evaporated.

The

massive position was maintained for years because it wasn't easy to

wind down. Any large-scale attempts to unwind the position would be

countered by other big traders and result in a loss. JPMorgan didn't

have to, though; it simply needed to rig the system to turn a buck.

A

precious metal trader named Andrew Maguire sent detailed information in

an email to the CFTC on Feb. 3, 2010, about what to expect in two days

after he noticed signals from JPMorgan and HSBC traders using

after-hours high-frequency trades to crush prices.

His description

was perfectly accurate. The trader, selling four hundred contracts per

second, dumped 45,000 contracts into the market. Each was for 5,000 troy

ounces for a grand total of 7,000 tonnes. The seller then suddenly

shifted and started purchasing everything he could. Still moving far

faster than other traders, he or she walked with $3.6 billion.

In

more recent history, JPMorgan has been holding about 25% of the silver

short market with the largest eight commercial silver shorts account for

50% to 60%. Estimates put paper silver positions at 143 times the

actual amount of physical silver traded.

Massive volumes of sell

orders are placed and canceled in fractions of a second by them. The

lower sell prices still appear in market data for anyone that cannot

handle trading by the millisecond, leading to panic selling by other

(much slower) traders.

The high-frequency trading system then

snaps up the positions for profit. After all, they never sold anything

to begin with... they simply maintained short positions and canceled

sales to buy at discounts.

read more : >>>> http://www.silverseek.com/article/why-silver-manipulation-so-absurd-12327

MAKE SURE YOU GET PHYSICAL SILVER IN YOUR OWN POSSESSION. Don't Buy SLV, or Futures or Pooled Accounts or any other BS paper silver product .Remember anything on paper is worth the paper it is written on. Go Long Stay long the bull market have even started yet

Everyone was clearly convinced the Fed was going to provide, with absolute clarity, what they were thinking in regard to tapering. This is despite them failing to do so every other time markets thought they might do just this.

Everyone was clearly convinced the Fed was going to provide, with absolute clarity, what they were thinking in regard to tapering. This is despite them failing to do so every other time markets thought they might do just this.